The quick answer: FintechZoom reports Tesla stock as a volatile but potentially lucrative investment. It highlights Tesla’s EV market leadership and cross-industry impact. While offering growth potential, investors should weigh the risks carefully.

Tesla, the electric vehicle giant led by CEO Elon Musk, has been a hot topic in the stock market for years. This article delves into FintechZoom’s coverage of Tesla stock (NASDAQ: TSLA), offering insights into its performance, potential, and market impact.

Contents

- 1 Overview of FintechZoom

- 2 Overview of Tesla Stock

- 3 Tesla’s Market Disruption Scenario

- 4 Broader Implications of the Tesla Phenomenon

- 5 Long-Term Prospects for FintechZoom Tesla Stock

- 6 The Model 3 Experience: Tesla’s Game-Changing Sedan

- 7 Tesla’s Energy Business: A Potential Game-Changer

- 8 Conclusion: Is Tesla a Good Investment?

Overview of FintechZoom

FintechZoom is a leading financial news and analysis platform. It provides real-time stock data, market trends, and in-depth research on various companies, including Tesla. The platform’s coverage of Tesla stock has gained significant attention from investors and Wall Street analysts alike.

Overview of Tesla Stock

Tesla Inc. (NASDAQ: TSLA) is a pioneer in the electric vehicle industry. Founded by Elon Musk, the company has revolutionized the automotive sector with its innovative approach to sustainable transportation. Tesla’s stock has been known for its volatility and impressive growth over the years.

Key points about Tesla stock:

- Trades on the NASDAQ under the ticker symbol TSLA

- Known for high volatility and significant price swings

- Often considered a leader in the broader electric vehicle market

- Closely tied to the performance of other Elon Musk ventures, such as SpaceX

Tesla’s Market Disruption Scenario

Tesla’s impact on the automotive industry has been nothing short of revolutionary. The company’s approach to electric vehicles, centered around popular models like the Model 3, has forced traditional automakers to rethink their strategies. This market disruption has led to several noteworthy events:

- Rapid adoption of electric vehicles worldwide

- Increased competition in the EV space

- Shifts in government policies towards sustainable transportation

Tesla’s innovative lithium-ion battery technology, developed in its Gigafactories, and Autopilot system have played a crucial role in this disruption. The company’s ability to consistently push boundaries, exemplified by products like the Cybertruck, has kept it at the forefront of the EV revolution.

Broader Implications of the Tesla Phenomenon

Tesla’s success extends beyond just the automotive sector. It has had far-reaching implications for various industries and market segments. Some key areas of impact include:

- Energy sector: Tesla’s advancements in battery technology, including the Powerwall, have implications for renewable energy storage.

- Tech industry: The company’s focus on software and AI, particularly in its Autopilot system, has blurred the lines between auto and tech sectors.

- Stock market dynamics: Tesla’s inclusion in the S&P 500 has influenced index fund compositions and market trends.

- Sustainable energy: Tesla’s Solar Roof initiative demonstrates the company’s commitment to a comprehensive clean energy ecosystem.

These implications highlight Tesla’s role not just as a car manufacturer, but as a disruptive force in multiple industries.

Long-Term Prospects for FintechZoom Tesla Stock

Analyzing Tesla’s long-term prospects involves considering various factors. FintechZoom’s coverage often highlights these key aspects:

- Production capacity: Tesla’s ability to scale production in its Gigafactories to meet growing demand

- Technological advancements: Ongoing innovations in battery tech and autonomous driving

- Global expansion: Tesla’s penetration into new markets, especially in Asia and Europe

- Competition: The rise of other EV manufacturers and traditional automakers’ EV efforts

- Regulatory environment: Interactions with agencies like the NHTSA and their impact on Tesla’s operations

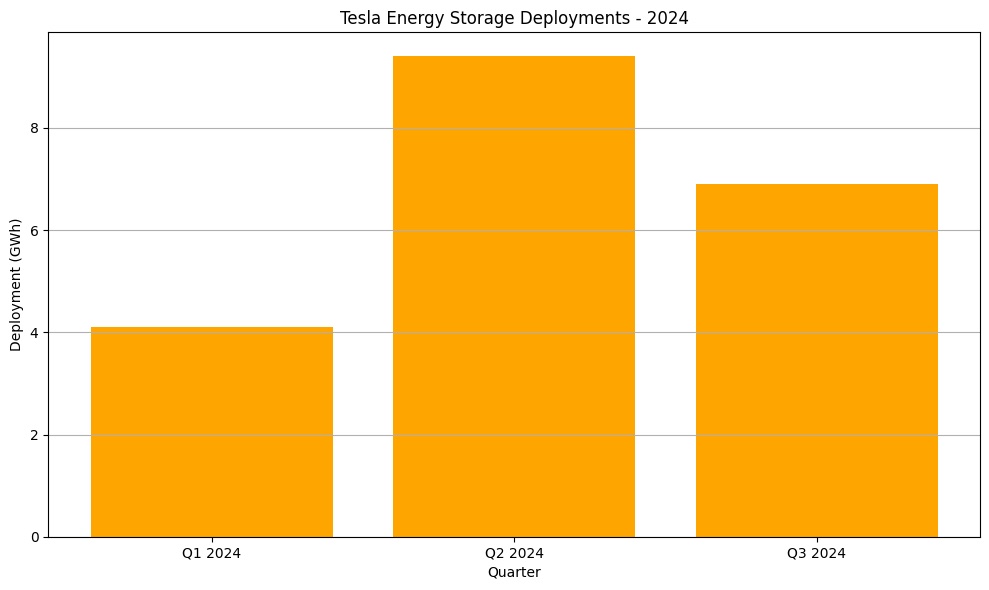

Recent developments have shown promising signs for Tesla’s energy storage business. In Q2 2024, Tesla Energy deployed a company record of 9.4 GWh of storage, driving record profits for this division. This success in energy storage solutions could potentially become Tesla’s next big earnings driver, diversifying its revenue streams beyond electric vehicles.

The Model 3 Experience: Tesla’s Game-Changing Sedan

The Tesla Model 3 has revolutionized the electric vehicle market with its blend of performance and affordability. Known for its incredible acceleration, the Model 3 can go from 0 to 60 mph in as little as 3.1 seconds, depending on the variant. Owners often rave about the minimalist interior, featuring a large central touchscreen that controls most of the car’s functions.

The Model 3’s long range, advanced Autopilot capabilities, and over-the-air software updates are other popular features that contribute to its appeal and strong market position. These features have helped solidify Tesla’s reputation for innovation and customer satisfaction in the EV market.

Tesla’s Energy Business: A Potential Game-Changer

Tesla’s energy storage business is emerging as a significant factor in the company’s long-term growth prospects. As the world shifts towards renewable energy, Tesla’s battery technology advancements are positioning the company as a leader in this space. The Powerwall for residential use and Megapack for utility-scale applications are expanding consumer choices in the energy sector.

These energy storage solutions not only complement Tesla’s electric vehicle business but also open up new revenue streams. The recent record deployment of 9.4 GWh of storage in Q2 2024 demonstrates the growing demand for Tesla’s energy products. This diversification could provide more stable cash flows, potentially making Tesla stock even more attractive to investors looking for long-term growth opportunities.

Conclusion: Is Tesla a Good Investment?

Determining whether Tesla is a good investment requires careful consideration. FintechZoom’s analysis often points to the stock’s potential for growth, balanced against its volatility. Investors should weigh Tesla’s innovative edge and market position against factors like valuation and competition.

Key takeaways:

- Tesla’s disruptive influence in multiple sectors offers growth potential

- The stock’s volatility may present both opportunities and risks

- Long-term success depends on Tesla’s ability to maintain its innovative edge

- The expansion of the Supercharger network could be a significant competitive advantage

Ultimately, the decision to invest in Tesla stock should align with individual investment goals and risk tolerance. As always, thorough research and possibly consulting with a financial advisor are recommended before making investment decisions.

We’d love to hear your thoughts! Have you invested in Tesla stock? What’s your view on the company’s future in both the EV and energy storage markets? Share your experiences and opinions in the comments below.